Keyword search

My Report

Innovating to enhance the quality of stakeholder interactions and experience

Digital strategy

The Bank’s transition towards a digital-first approach is evident in its strategic evolution over the years, progressing from emphasising technology leadership to enhancing digital usage and prioritising customer experience.

2019

Lead through Technology

2020

Reach out to popularise digital channels to reach high

2021

Let’s innovate to launch pioneering new products, acquire new relationships, improve speed of delivery

2022

Lets transform together for future ready Bank

2023

Power to you

Investments in the Bank’s digital ecosystem have laid a strong foundation, enabling it to tackle emerging challenges and excel in the digital payment landscape. Through innovative initiatives and technological advancements, the Bank has emerged as a leader, benefitting both retail and corporate customers.

Remaining committed to fostering a digital culture, the Bank actively recognises and implements digital initiatives, leveraging integrated technologies and striking a balance between traditional and digital channels. It integrates legacy systems, conducts strategic experiments, facilitates smart interactions and enhances the digital experience for stakeholders. The Bank’s digital efforts have garnered recognition, earning awards and accolades. As the top facilitator of CEFT transactions in Sri Lanka, the Bank recorded over 19.2 million transactions worth Rs. 2,361 Bn. in outward CEFT and over 25.9 million transactions worth Rs. 2,307 Bn. in inward CEFT transactions in 2023. Stakeholders have embraced digitalisation, demonstrating increased proficiency in navigating the digital learning curve, leading to broad acceptance of digital banking. Consequently, the Bank observed a robust 46% year-on-year growth in its digital banking retail customer base, while its digital banking business customer base exceeded 72,000 users.

Investments in IT infrastructure

Table - 11| Indicator/Year | 2023 Rs. Mn. |

2022 Rs. Mn. |

2021 Rs. Mn. |

2020 Rs. Mn. |

2019 Rs. Mn. |

| Investments in Hardware (Computer Equipment) | 1,450 | 2,441 | 434 | 506 | 568 |

| Investments in Software (Licenses etc.) |

1,116 | 2,218 | 768 | 409 | 387 |

| Total | 2,566 | 4,659 | 1,202 | 915 | 955 |

Migration to digital channels

Table - 12| Indicator/Year | 2023 | 2022 | 2021 | 2020 | 2019 |

| Number of existing customers migrated to online banking | 335,322 | 265,183 | 212,806 | 157,599 | 109,873 |

| New customer acquisition through digital channels |

8,504 | 9,539 | 12,491 | 16,327 | 14,957 |

Total financial transactions initiated through digital channels

Table - 13| Indicator/Year | 2023 | 2022 | 2021 | 2020 |

| Number of transactions (Million) | 58.265 | 49.087 | 37.842 | 23.724 |

| Value of transactions (Rs. Bn.) | 4,581 | 3,586 | 2,356 | 1,386 |

| % of customer transactions below Rs. 200,000 | 94 | 94 | 92 | 97 |

| Growth in number of transactions (YoY) (%) | 19 | 30 | 60 | 10 |

| Growth in value of transactions (YoY) (%) | 28 | 52 | 70 | 22 |

The Bank was awarded the title of “Best Bank for Digital Solutions in Sri Lanka” for the year 2023 by the esteemed UK-based Asiamoney Magazine. This recognition further solidifies the Bank’s standing as a frontrunner in digital innovation within the country.

Digital Penetration

36% – 2023 (29% – 2022)

Digital roadmap 2023–2025

In line with the Bank’s digital vision of fostering a digital economy that caters to every customer’s technological proficiency, the Bank’s digital strategy primarily targets retail customers, encompassing a wide array of products, services, processes and interaction points. The forthcoming digital transformation, spanning the next two years, is guided by the following objectives:

- Service transformation to achieve service excellence.

- Operational transformation to be more efficient and effective.

- Digital transformation to reaffirm digital leadership.

- Talent transformation to enhance performance.

As part of this strategy, the Bank reaffirms its dedication to continuous investments in the conversion of conventional banking procedures into digital workflows. Emphasising seamless integration with external ecosystems and the improvement of internal systems takes precedence to ensure flexibility amidst anticipated changes in regulatory and risk management frameworks. Alongside these initiatives, the Bank will concentrate on re-skilling its staff and acquiring talent in specialised areas, forging strategic partnerships and fortifying its data capabilities, highlighting the ongoing areas of focus.

The Bank’s commitment to be at the forefront of technological innovation and efforts to continually strive to develop cutting-edge products and services that cater to the evolving needs of its customers is evident from the following array of products.

ComBank Digital

The Bank has achieved groundbreaking status in the banking sector with the launch of “ComBank Digital”, the country’s first Omni-channel online banking solution. Currently, ComBank Digital boasts a sizable user base of approximately 1.2 million subscribers and efficiently handles an average of over three million financial transactions each month. This solution has garnered widespread praise from users, solidifying its position as the top-rated Sri Lankan financial app in the AppStore.

ComBank Digital is easily accessible via a responsive web application and three native mobile applications, ensuring compatibility with various devices, including desktop Personal Computers, laptops, tablets and smartphones. The platform is equipped with internationally recognised user security features that adhere to industry standards, providing users with peace of mind.

Moreover, “ComBank Digital” offers a comprehensive range of services, catering to various banking needs such as basic account inquiries, bill payments, fund transfers, instant payments to government institutions, international fund transfers, fixed deposit investments, credit card payments, savings goal setting, convenient transfer orders and loan applications, covering every aspect of a customer’s banking requirements.

Additionally, the platform introduces several pioneering features, including the integration of “Widgets” for added convenience, the ability to create savings “Objectives” to assist users in achieving their financial goals, automated redemption of ”eFDs” (electronic fixed deposits), creation of secondary accounts like ”eSavings and eMoney market accounts” and the provision of a dedicated mobile banking application tailored specifically for business customers, highlighting its commitment to delivering a unique and personalised banking experience.

Enhancing the platform’s capabilities are various user-friendly self-assisted functionalities, including automatic password recovery, customisable alert setups, management of transaction limits, 24/7 instant payment capability and a dedicated YouTube channel for user awareness. Moreover, informative features such as viewing images of issued and deposited cheques, self-managed services like alert delivery and alert setup management, beneficiary creation, Bank Statement download in PDF format, request for card replacements and graphical representations for exchange rate inquiries to track fluctuations are incorporated. Robust security features allow users to block credit/debit cards when needed and facilitate secure communication with the Bank through attached documents and a comprehensive message reply history, collectively providing a comprehensive and secure banking experience.

Recent upgrades to the ComBank Digital platform encompass several key enhancements. These include the addition of an OTP auto-fill option for user convenience, improvements to cyber receipts to enhance transaction security, the introduction of a multilingual application to cater to diverse user needs and the activation of cards/cards PIN reset feature for enhanced user control and security. Furthermore, enhancements to the Biller Module are currently underway and will be implemented shortly to further improve the platform’s functionality.

Commercial Bank has expanded its digital platform to its overseas operations in Bangladesh and Maldives as well.

eFDs opened during the year as a percentage of total FDs opened

50% – 2023 (27% – 2022)

Flash toolkit

The “Flash Digital Bank account” was introduced with a focus on the digitally inclined new generation, catering to their preference for digital banking channels. A standout feature of self-registration ensures a seamless onboarding experience, distinguishing the app from competitors. The Flash app offers a comprehensive suite of financial services and wealth management tools. Notable features include the introduction of the ”Flash Teen Digital Bank account" under the name “Flash Fam” for teens, non-face-to-face customer onboarding via Digital KYC and the release of Flash 4.2. with a new look and feel.

The Flash Digital Bank Account received recognition at the 2023 NBQSA ICT Awards and planned to allow all Sri Lankans working abroad to open an account. Key features include tri-lingual accessibility, a unique Hospitalisation Support Insurance Plan, fund transfers, actionable alerts, biometric login, savings targets, group payments, QR code and NFC payments and spend tracking.

Future plans include enabling a Smart loan facility, expanding to other corridors, introducing an In-app Virtual assistant, launching transactional wearable banking and implementing voice banking. Additionally, partnerships with Fairfirst Insurance enhance the offering, with further plans to introduce more innovative features.

Flash was selected as the Best Digital Account by Global Retail Banking and Innovation Awards 2023, The Digital Banker Magazine Singapore and also represented Sri Lanka at APICTA Awards 2023 held in Hong Kong.

ePassbook

The Bank has launched the “ePassbook” facility, a mobile application enabling account holders to conveniently access and view their account transactions on Android or Apple smartphones, online and offline. This feature mirrors traditional savings passbooks, offering a comprehensive account history and real-time transaction view. Eligible account holders can self-register via the “ComBank ePassbook” app without branch visits, with options for authentication preferences. The service is free and provides benefits such as balance checks, transaction views and account nickname settings for easy reference. Additionally, users can access exchange rates, interest rates, ATM/Branch locations and search transactions by key names. They also have the flexibility to self-enroll/remove accounts.

WhatsApp Banking

Commercial Bank has pioneered the introduction of ”WhatsApp Banking”, becoming the first bank in Sri Lanka to offer this innovative service. This initiative underscores the bank’s commitment to utilising cutting-edge technologies to enhance customer experiences. Through WhatsApp Banking, account holders can conveniently access features such as Account Balance, Account History and Cheque Book requests. Additionally, both customers and non-customers can inquire about Fixed Deposit rates and foreign exchange rates. The platform also allows for self-registration with the ComBank Digital app and facilitates the opening of new accounts through the Flash Digital Bank Account, ensuring a seamless and efficient banking experience. The benefits of WhatsApp Banking include its safe, secure and contactless nature, offering up-to-date banking information at no cost. Furthermore, the service caters to both account holders and non-customers and enables the online opening of accounts. Additionally, WhatsApp Banking facilitates loan leads, forwarding successful loan requests to the Retail Products Department.

Bank with ComBank on Viber

“Bank with ComBank on Viber” extends accessibility to all Commercial Bank customers with registered mobile numbers, as well as non-customers interested in opening an account with Commercial Bank, ensuring inclusivity. This service offers real-time customer support and utilises an AI Chat-Bot to provide banking services 24/7, enhancing user experience. With trilingual accessibility, users can conveniently engage with the platform. Benefits include the ability to check account balances, view account history (last three transactions), place Cheque Book requests, inquire about Fixed Deposit rates and Exchange Rates. Users can also self-register or access the “ComBank Digital” platform and open a new account through the “Flash Digital Banking App.” Additionally, loan applications for Personal Loan, Home Loan and Leasing are available through this service, providing comprehensive banking solutions.

Paymaster

”Paymaster” provides an efficient solution for consolidating various payment processes, spanning employee salaries, supplier payments, interests, dividends, agent commissions and statutory payments. Users can easily upload ETF/EPF contributions and surcharges digitally through Paymaster, enhancing security and bypassing the challenges associated with cash and cheques. Notable features include bulk payment capabilities, real-time credit to ComBank and other banks, round-the-clock payment access and flexible authorisation levels. Accessible via web or mobile app, Paymaster processes transactions above Rs. 5 Mn. via RTGS. Benefits encompass reduced risk in cash transportation, streamlined manual payment processing, immediate disbursement to both Commercial Bank and other banks, lowered transaction costs and connectivity to Commercial Bank’s extensive network of branches and ATMs. With Paymaster, users enjoy enhanced security and convenience, eliminating the need for traditional payment methods like cash and cheques.

Future plans include enabling this capability through Host-to-Host (H2H) services enabling corporates to seamlessly integrate their ERP systems with that of the Bank for a real time 24/7 corporate payments.

Advancing card and cashless initiatives

The Bank has implemented a comprehensive strategy to promote card and cashless initiatives, utilising AI-based algorithms and predictive modules to identify and address specific gaps. Through the deployment of an AI-based data analytic tool by the Card Centre, transaction visualisation, segmentation, promotion and churn prediction modules have been facilitated. Various innovative products and services have been introduced to meet evolving customer needs and industry trends.

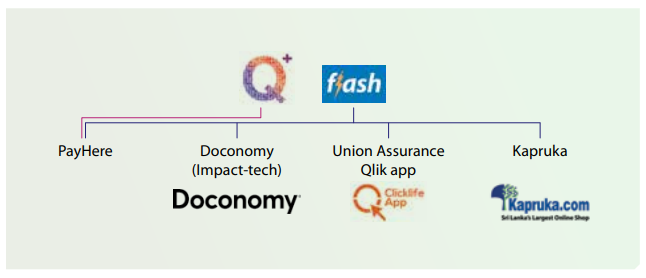

Among these initiatives, the introduction of “Visa Direct” and “MasterCard Send” card-based fund transfer facilities has notably enhanced functionality and convenience for debit and prepaid cardholders, allowing them to transfer funds to any locally-issued Visa and MasterCard debit, credit, or prepaid card through the Bank’s ATMs, CRMs and Q+ Payment App. Additionally, the Bank pioneered card acceptance through Android smartphones in Sri Lanka, enabling merchants to conveniently and cost-effectively accept card payments using their mobile devices via the “Tap to Phone” feature, thereby revolutionising the digital payment landscape.

In collaboration with LankaPay, launched a national credit and debit card with international acceptance. This is the first launch of LankaPay Credit Cards in Sri Lanka and the first time five variants of LankaPay cards-three credits cards and two debit – cards were launched by a Sri Lankan Bank. This National Card Scheme is an initiative implemented by LankaPay in partnership with JCB International Co. Ltd.

In efforts to promote sustainability, the Bank has replaced paper receipts with digital receipts for ATM and CRM withdrawals, reducing paper waste and supporting environmental conservation. Furthermore, initiatives aimed at expanding digital reach include the enhancement of the Q+ Payment App, the introduction of a missed call SMS facility for checking credit card balances and the launch of Simplified Commerce – SimplePay facility to facilitate digital payments, particularly for SME merchants. Additionally, the Bank has enabled the Send Money facility to any local bank card through ComBank CRMs, further enhancing customer convenience.

The Bank’s commitment to innovation and service excellence is evident in its launch of 90 new products and services since 2016, with 30 of these being “Sri Lanka’s first” launches. These include groundbreaking initiatives such as the introduction of the 1st LANKAQR supported Android POS machine, UnionPay QR facility for consumers and merchants, UnionPay Contactless Card issuance for Sri Lanka and the launch of the Q+ Payment App, among others. In terms of service standards and internal processes, the Bank focused on automating credit card capturing and evaluation processes, implementing a Smart Collect recoveries software, automating CRIB reports through a BOT, developing a workflow system for scanned image processing of a Credit Card and archival, Credit Card status report for Sales and Branches, developing a workflow system to handle all service requests for Debit and Credit Cards, implementing Mastercard Payment Gateway Services and Cybersource for IPGs and developing AI-based data analytics tools to support cardholder visualisation and monitoring.

New product and feature developments lined up for implementation in 2024 include Trilingual for Q+ Consumer payment app, WeChatPay & AliPay with LANKAQR, Enabling self-care features (Do it yourself) such as Card activation/deactivation, Customer initiated installment plans, PIN resets, etc., Popularising Card-less & Contactless transactions, further improvements to the ATM Interface including new convenient features, further feature enhancements to improve Card-less and contactless payments, implementing all modes of LANKAQR payments including addition of other Bank CASA and Cards.

Through these initiatives, the Bank has been able to facilitate growing digitalisation requirements for both cardholders and merchants, expand Digital Bill Payments options by creating additional channels, facilitate Central Bank initiatives in growing and popularising QR code based payments as a low cost, instant & convenient payment acquiring solution for merchants and comply with latest global security and compliance requirements for payment cards industry.

Since 2016, Commercial Bank’s cards have experienced rapid growth, becoming the fastest-growing cards in Sri Lanka and dominating the market with a 23% share in combined credit and debit card spending, by the end of 2023. Additionally, by the close of 2023, Commercial Bank ranked second in overall card acceptance in Sri Lanka, according to both Mastercard and Visa. The Bank’s Point-of-Sale (POS) network has earned recognition from Visa for having the highest coverage in Sri Lanka, available at numerous locations across the country. Equipped with ‘Tap n Go’ NFC technology, Commercial Bank’s cards are supported by a robust NFC POS network. Moreover, the Bank’s credit and debit cards offer continuous promotions and Easy Payment Plans for a wide range of products and services. Notably, Commercial Bank was the pioneer in offering loyalty rewards for both credit and debit cardholders through its Max Loyalty Rewards scheme. Furthermore, it stands out as the sole bank in Sri Lanka to provide Visa, MasterCard, UnionPay and LankaPay JCB brands for both card issuance and acquiring, enhancing its versatility and accessibility in the market.

Growth in Credit Card Portfolio YoY

– Issuance Growth – 27%

– Usage Growth – 24%

Growth in POS Terminals YoY

– POS Terminals – 17%

– POS Transaction Volume – 57%

– POS Transaction Value – 42%

Growth in customer registrations for Q+ Payment App YoY

– Card Added Customer Base – 92%

Growth in LANKAQR Merchants YoY

– LANKAQR Merchants Growth – 20%

Strategic partnerships for co-branding:

Card Schemes – VISA, MasterCard, UnionPay, LankaPay JCB

Co-branded Credit Cards – Mobitel, Sri Lanka Insurance Corporation, Nuwara Eliya Golf Club (NEGC)

Affinity Credit Cards – Wesley College, Dharmaraja College, Maris Stella College, St. Anthony’s College and Dharmasoka College

Co-branded Debit Card initiatives – Insee, JAT

Integration of PayHere with Q+ Payment App

Enabling “Tap to Phone” Card Acceptance through PAYable

Three Send Money Options via Q+ Payment App; Card to Account, Card to Card and Card to PEN

Digital Receipts for ATM/CRM Withdrawals

Technology roadmap

The Bank is embarking on an ambitious endeavour to bolster its technological infrastructure and digital capabilities, aligning closely with its commitment to offer best customer experience while enhancing operational efficiency, augmenting security and enabling expanding operations to new revenue lines and geographies with minimum distractions and effort. The Bank has a unified technology roadmap that encompass plans for digital, IT, security, analytics etc. which will on one hand address capacity enhancements while others are for augmenting customer functionality.

This required completion of a few core projects that got postponed due to disturbances from the operating environment, on a priority basis. These included upgrades to software and hardware platforms to enhance capacity, a new enterprise infrastructure in terms of perimeter/virtual firewalls, networks and switches and reaching an agreement for a new blueprint for our systems architecture. In terms of upgrades, the Bank implemented a new AS400 system alongside upgrades to key platforms like ComBank Digital and Flash in 2024 while upgrades to the software stack included T4S Teller system, Loan Origination System (LOS), new Treasury System and a data loss prevention system. Projects in the pipeline include an Identity and Access Management System, MicroService implementation, Corporate Banking Digital Platform, Interactive bank and card statements. Further, the Bank has plans to enhance lower counter operations by automating customer interactions that take long time (such as account opening) through an integrated device. Most of the branch operations will be centralised, thereby relieving the branch staff for customer engagement.

With the implementation of the plans in the Roadmap for the immediate future, the Bank will be offering fully automated approvals for personal loans, leasing and housing loans (to some extent) and credit cards online, particularly for existing customers. The planned implementations will also enable the Bank to scale up operations efficiently and cost effectively. A customer experience measurement platform too will be implemented shortly which will tag customer transactions for feedback to obtain insights on customer interactions with the Bank and identify improvements required. This will enable the Bank to gradually standardise service quality across all the touch points in the network which will help the Bank to differentiate its offering. The Bank expects to make a paradigm shift in its sales culture through the implementation of a CRM system with added functionalities such as sales tracking from end to end. The Bank aims to encourage digital usage among customers through robust loyalty programmes, leveraging data analytics and AI-driven predictive modeling to personalise offerings based on historical data insights. The Bank will enable host-to-host (H2H) connectivity for corporate customers enabling them to connect their ERP systems to the Bank. With the guidance of a consultant who is already on board, the Bank will augment its data analytics capabilities and data visualisation and build use cases to address pain points in the operations. The Human Resources Information System will be upgraded for better talent management.

These efforts underscore the Bank’s dedication to continuous improvement and its pursuit of digital excellence. Through these multifaceted initiatives, the Bank aims to leverage technology, data analytics and AI to elevate customer experience, streamline processes and maintain a competitive edge in the ever-evolving digital landscape.