Keyword search

My Report

Providing the experience, simplicity and convenience that customers value most today

The Bank's commitment to customer centricity is exemplified through its proactive efforts to maintain transparent communication, provide tailored solutions through segmentation and foster meaningful relationships with its customers. By prioritising transparency in its communication, the Bank ensures that customers are kept informed about products, services, policies and any changes that may impact them. This openness not only builds trust but also helps manage customer expectations and address concerns effectively. Furthermore, the Bank goes above and beyond to understand the unique needs of its customers and offer personalised solutions that align with their financial goals and aspirations. Whether it is restructuring loan facilities to provide relief during challenging times or offering specialised accounts and services to cater to specific customer segments, the Bank demonstrated its dedication to meeting the diverse needs of its clientele. Moreover, by organising capacity building programmes, SME fairs and clinics, the Bank created opportunities for customers to enhance their skills, expand their networks and access resources that contribute to their financial well-being and success. Overall, the Bank's customer-centric approach permeates every aspect of its operations.

Customer segmentation

The Bank utilises customer segmentation as a strategic approach to better understand and address the unique needs and preferences of each segment, enabling it to provide tailored solutions to its customers, offering products and services that not only met but often surpassed their expectations. This required internal adaptations and process enhancements to ensure agility and relevance. By segmenting its diverse customer base and providing exceptional services accordingly, the Bank aimed to enhance the Commercial Bank brand, fostering stronger customer loyalty and engagement. This segmentation strategy is illustrated in tables 09 and 10 below.

Customer segmentation

Table - 09| Criteria | High net-worth | Corporate | SME (Small and Medium Enterprises) | Micro customers | Mass market |

| Income/Size of relationship/ Business turnover/Exposure |

Individuals with banking relationships above set thresholds | Exposure> Rs. 250 Mn. |

Exposure< Rs. 250 Mn. |

Exposure< Rs. 1 Mn. |

Individuals not falling into other categories |

| Price sensitivity | High | High | Moderate | Low | Low |

| Products of interest | Investment | Transactional, trade finance, and project loans |

Leasing and project financing |

Transactional | Transactional |

| Number of transactions | Low | High | High/Moderate | Low | Low |

| Level of engagement | High | High | High | Low | Low |

| Objective | Wealth maximisation | Funding and growth |

Funding, growth and advice | Funding and advice |

Personal financial needs |

| Background | Elite business community/ professionals | Rated, large to medium corporates/MNCs |

Medium business | Self-employed | Salaried employees |

| Number of banking relationships | Many | Many | A few | A few | A few |

| Level of competition from banks |

High | High | Moderate | Low | Moderate |

Channel mix and target market on perceived customer preference

Table - 10| Customer segment | Branches | Internet & Mobile Banking |

ATMs/CDMs CRMs |

Call centre | Relationship managers |

Business promotion officers |

Premier banking units |

| High net-worth |  |

|

|

|

|

|

|

| Corporates |  |

|

|

|

|

|

|

| SMEs |  |

|

|

|

|

|

|

| Micro |  |

|

|

|

|

|

|

| Millennials |  |

|

|

|

|

|

|

| Mass market |  |

|

|

|

|

|

|

Crafting a Customer-Centric Future

Commercial Bank's Journey Towards Customer Experience Excellence

In response to the increasingly competitive banking landscape, Commercial Bank recognises the paramount importance of excelling in customer experience as a key differentiator. With a steadfast commitment to understanding and fulfilling customer needs, the Bank established the Customer Experience Unit in late 2023, signalling a transformative journey towards elevating service standards. This focus on customer-centricity is deeply ingrained in the Bank's Vision, Mission and 12 service commandments, which prioritise surpassing customer expectations and fostering loyalty through passionate service and cutting-edge technology enabling seamless interactions.

Six pillars of the strategic journey towards a Customer-Centric Culture

1

The Bank aims to instill a customer-first culture through targeted training and empowerment programmes for its workforce,

2

A robust Customer Excellence Governance Framework ensures consistency and high-quality service delivery through policies, service-level agreements and a dedicated Customer Experience Steering Committee,

3

Active engagement and proactive empathy are prioritised to anticipate and address customer needs effectively,

4

Product and service offerings are tailored to evolving customer needs through data analysis and persona creation

5

Best-in-class customer management and communication practices are adopted to enhance interactions across all channels and

6

Strategic action plans are implemented to translate these goals into tangible outcomes, including customer persona creation, journey mapping, standardised communication protocols and structured feedback gathering.

Led by the Chief Manager - Customer Experience, the Customer Experience Unit represents a strategic shift towards customer-centricity. With a dedicated focus on passionate service, active engagement and superior customer service, the Bank aims to set new benchmarks in customer satisfaction starting from 2024 and establish itself as a service leader in the banking industry.

A measure of customer satisfaction

In 2022, the Bank enlisted Kantar Research to assess customer satisfaction levels. The Bank attained an outstanding total TRI*M score of 101 for Corporate Banking, surpassing the regional benchmark of 85 and indicating excellence within the range of 100 – 150. In Retail Banking, the TRI*M score was 85, the highest among competitors whose average score was 74. Additionally, the Bank achieved the second-highest TRI*M score of 92 for SME Banking. The Bank will continue to monitor the customer satisfaction levels.

Acquiring a new Corporate Digital Platform

The Bank is planning to acquire and deploy a robust corporate banking App with comprehensive front-end and back-end capabilities. This App aims to prioritise customer-centricity by covering various aspects of corporate banking, including lending, deposits, trade and treasury services. By identifying all service and revenue points, the App intends to streamline processes and enhance efficiency.

One of the key objectives of the proposed app is to address challenges related to talent loss, skill deficiencies and personal biases by automating repetitive tasks, audits and workflows. This automation will help mitigate the impact of talent gaps and ensure consistency in service delivery.

Moreover, the introduction of this corporate banking App signifies a strategic shift for the Bank, transitioning from a traditional brick-and-mortar institution to a modern entity with cutting-edge digital capabilities. By embracing state-of-the-art technology and leveraging its financial strength, the Bank aims to further strengthen its formidable position in the corporate banking sector.

Overall, the acquisition and rollout of this corporate banking App represents a significant step towards enhancing the Bank’s competitiveness, improving operational efficiency and meeting the evolving needs of corporate clients in today's digital era.

Uplifting the Small and Medium Enterprises (SMEs)

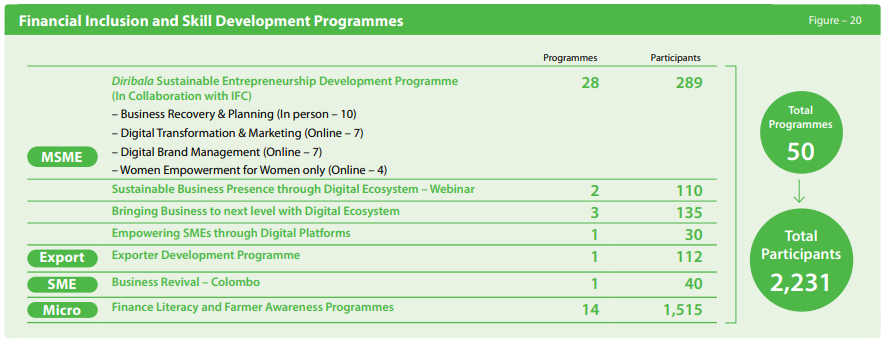

The Bank recognises the crucial role of SMEs in the Sri Lankan economy and is deeply committed to supporting their growth through a range of financial products and services. Fourteen dedicated SME Managers appointed to support all the regions and there are 57 dedicated Branches established as SME Cluster branches demonstrate this commitment. As part of this commitment, the Bank prioritises the development of financial literacy and capacity building among SMEs. To this end, the Bank organised webinars aimed at helping SMEs expand into new markets, utilise non-financial services and establish connections with supply chains and exporters. Additionally, the Bank provided training to SMEs on various topics including entering the export market, product marketing and leveraging international methodologies to access new markets. During the year, the Development Credit Department of the Bank conducted 50 awareness programmes for over 2,200 Micro-SMEs (MSMEs), Women SMEs (WSMEs) and prospective SMEs. Further details on these SME training programmes can be found on page 81 of this Report. In addition, the Bank actively participates in MSME support initiatives organised by external institutions, facilitating financial literacy and awareness sessions on various topics such as waste management and renewable energy. These collaborative efforts, supported by stakeholders such as the Central Bank and government agencies, aim to empower MSMEs and enhance their competitiveness in the market.

In this regard, it is noteworthy to mention that the Ministry of Finance, Sri Lanka, recognised Commercial Bank as the leading SME lender for the years 2020, 2021 and 2022 underscoring the Bank’s dedicated focus and commitment to the SME Sector.

| Number of loans | Loan value (Rs. Mn.) | |||

| Year/Sector | 2022 | 2021 | 2022 | 2021 |

| Agriculture | 3,470 | 2,974 | 19,890 | 17,574 |

| Services | 4,254 | 5,814 | 29,040 | 40,398 |

| Industries | 7,531 | 31,538 | 49,068 | 111,742 |

| Other | 41,060 | 3,101 | 137,101 | 26,138 |

| Total | 56,315 | 43,427 | 235,099 | 195,852 |

Awareness programme for WSMEs

ComLEAP – Online Business Ecosystem in partnership with GlobalLinker

In the realm of digital transformation, the Bank pioneered a ground-breaking initiative in Sri Lanka's banking sector by introducing the ”Commercial Bank LEAP GlobalLinker”, providing a suite of services free of charge. This innovative digital business ecosystem is designed to enhance the global reach SMEs and MSMEs, connecting them with markets spanning over 150 countries. With a focus on fostering cross-border collaborations and opening doors to new opportunities, the platform has already attracted over 8,000 customers, including leading manufacturers, exporters and women-led SMEs from across the country.

Moreover, the platform has facilitated over 90 entities to share their success stories, contributing to its growing significance within the business community. The Bank’s dedicated SME teams are actively engaged in customer acquisition efforts, organising events in collaboration with government institutes, chambers and organisations to highlight the platform’s value proposition. The Commercial Bank LEAP GlobalLinker distinguishes itself with advanced features such as e-stores, digital catalogues and an enhanced online presence, offering a dynamic environment for businesses to thrive in an interconnected global landscape.

Moving forward, the platform is poised for further growth and innovation, with plans to onboard additional partners and expand its features to meet evolving business needs. The IFC has played a pivotal role in providing advisory support for the successful implementation of this transformative initiative, which marks a significant milestone in Sri Lanka's digital banking landscape. Additionally, webinars and structured entrepreneurial skill development programmes conducted in collaboration with IFC have further underscored the Bank’s commitment to embracing digital solutions and fostering economic advancement for businesses.

ComBank BIZ Club

Since its establishment in 2017, the ”ComBank BIZ Club” has persistently supported SMEs, offering more than just financial aid. Its membership has exceeded 5,600, representing majority of the Bank’s SME customers by December 31, 2023. The Club provides an array of advantages to its members, such as complimentary financial advisory services and access to specialised business seminars, contributing significantly to their business growth. Additionally, since establishment of the Club, the Bank has conducted over 2,200 financial literacy programmes, benefitting over almost 15,000 MSME customers to date.

The Bank initiated a widespread extension of microcredit facilities to support MSMEs during an impending crisis. Equipped with microfinancing, small business owners were empowered to navigate challenging situations and access the Bank's value creation processes. To aid SMEs in recovery, a dedicated Business Rehabilitation & Revival Unit was established, along with measures like NPCF management, staff redeployment, regional rehabilitation centers and loan delinquency management.

In challenging economic circumstances, the Bank collaborated closely with SMEs, offering concessions through loan restructuring and rescheduling. SME officers underwent training to better understand SMEs and implement adaptable practices for their recovery. As moratoriums on SME loans concluded in January 2023, revised repayment schemes and restructured loans with concessions were introduced to support the hardest-hit SMEs through 2023 and beyond.

SME Trade Fair conducted by the Bank

The Commercial Bank of Ceylon’s impactful efforts to support the local SME sector were recently acknowledged on a global platform when the Bank won the award for the 'Best SME Bank' in Sri Lanka from New York -head quartered Global Finance magazine.

Chief Operating Officer, Mr S Prabagar accepting the award for the “Best SME Bank” in Sri Lanka by the Global Finance Magazine at the Awards Ceremony held in London

Conducting capacity building programmes and training sessions for SMEs

The Bank conducted capacity building programmes and training sessions for SMEs with the aim of enhancing their knowledge, skills and capabilities to navigate business challenges and seize growth opportunities. These programmes focused on improving financial literacy, essential business skills, and industry-specific expertise.

Financial literacy training equipped SMEs with the understanding of financial management, budgeting and cash flow analysis, empowering them to make informed financial decisions and plan for growth effectively. Additionally, training sessions covered essential business skills such as marketing strategies, product development, customer relationship management and human resource management, enhancing SMEs’ competitiveness and overall performance in the market.

Moreover, specialised training sessions addressed industry-specific knowledge and expertise, providing insights into the latest trends, technologies and best practices relevant to sectors like manufacturing, agriculture and technology. These programmes helped SMEs innovate, adapt to market changes and stay ahead of the competition.

The Bank offered a variety of learning formats, including workshops, seminars, online courses and mentoring sessions, to provide accessible and practical learning opportunities tailored to the needs of SMEs.

The benefits of these capacity building programmes were manifold. They contributed to the growth and development of the SME sector, fostering entrepreneurship, innovation and economic diversification. Additionally, they promoted job creation, poverty reduction and improved standards of living within local communities.

In the agriculture sector, the Bank provided advisory and consultancy services through initiatives such as sessions on improving savings habits and loan schemes conducted by the Development Credit Department. Technical sessions on soil fertilisation and machinery usage, led by relevant organisations like TRI and TSHDA, aimed to enhance productivity and sustainability among farmers and entrepreneurs in the agriculture sector.

Enhancing the literacy of SMEs in areas such as entering the export market and marketing products

The Bank recognised the significance of SMEs in driving economic growth and innovation, yet acknowledged their challenges in entering the export market and marketing their products effectively. To address this, the Bank undertook initiatives to enhance SME literacy in these areas.

In terms of entering the export market, the Bank provided SMEs with knowledge and skills to navigate global trade complexities. This included understanding market trends, consumer preferences and legal frameworks governing international trade. By equipping SMEs with this knowledge, they could identify export opportunities, target suitable markets and ensure compliance with export regulations, thereby facilitating smooth operations and minimising legal risks.

Similarly, the Bank focused on enhancing SME literacy in marketing to empower businesses to effectively promote their products and reach target customers. This involved understanding consumer behaviour, market segmentation and digital marketing strategies. By conducting market research and leveraging digital platforms, SMEs could tailor their marketing campaigns to resonate with their audience, increase brand awareness and drive sales.

Overall, these initiatives aimed to equip SMEs with the knowledge and skills necessary to overcome barriers in entering the export market and implementing effective marketing strategies, thereby fostering their growth and competitiveness in the global marketplace.

Details of a training programme conducted during the year are given below;

| Target audience | Details of content | Resource persons | Number of participants |

| MSME/Indirect Exporters/Local Producers | Industry Overlook Export Procedures Potential Industries/Markets Standards and Good Manufacturing Practices Certifications |

Officials of Industrial Development Board/Export Development Board/ Sri Lanka Standards Institution/ National Plant Quarantine Services |

112 |

Conducting SME fairs and clinics to develop networks and resolve problems

The Bank utilised SME fairs and clinics as well as the Biz Club strategically to extend networking opportunities and support the growth and resilience of SMEs. These events served as platforms for SMEs to build connections with each other as well as government institutions and industry stakeholders, showcase their products, engage with potential partners and customers and address challenges they faced. The primary objectives were to cultivate networks among SMEs and offer solutions to their problems.

SME fairs provided them with valuable networking opportunities, bringing together various stakeholders such as other SMEs, industry experts, governmental bodies and potential clients. This facilitated collaboration, knowledge-sharing and the establishment of mutually beneficial relationships, enabling SMEs to forge partnerships and explore new markets, thereby leveraging resources and support systems conducive to their growth.

Similarly, SME clinics offered SMEs a platform to seek expert advice on specific challenges, including financial management, marketing strategies and digital transformation. With facilitators knowledgeable in various fields, SMEs could overcome obstacles and enhance operational efficiency, leading to sustainable growth.

Moreover, SME fairs and clinics served as catalysts for innovation and entrepreneurship within the SME community, showcasing innovative products and services, business models and inspiring creative approaches. These events helped raise awareness of the importance of the SME sector, share success stories, explore new opportunities and provide access to resources and support services, empowering SMEs to thrive.

Beyond networking and problem-solving, SME fairs and clinics contributed to the broader development of the SME sector by raising awareness of its significance in the economy and the available support mechanisms. These events provided platforms for governmental agencies, financial institutions and other stakeholders to showcase their initiatives, programmes and services tailored to SME needs. By facilitating access to resources, funding and expertise, SMEs were empowered to thrive. Additionally, the events facilitated knowledge exchange, learning and capacity building among SMEs, essential for their long-term sustainability and success.

The digital ecosystem, Commercial Bank LEAP GlobalLinker too supports MSMEs and enhances global market access, addressing key pain points and promoting business networking on a global scale.

| Year | Details of the events |

| 2022 | ComBank SME Trade Fair 2022 (Own)

|

| 2023 | Launching of own Digital Business ecosystem in the name of Commercial Bank LEAP GlobalLinker IDB Trade Fair – Kandy (External) IDB Trade Fair – Jaffna (External) Trade Fair of Sri Jayewardenepura University (External) |

Restructuring and rescheduling of loan facilities

The Bank offered concessions to individuals and businesses by restructuring and rescheduling loan facilities, particularly those emerging from moratoriums, to provide support during challenging times. This approach allowed borrowers to adjust repayment plans according to their current financial capabilities, offering relief and a pathway to financial recovery.

During economic downturns and crises, borrowers faced difficulties meeting loan obligations, leading to increased defaults. By offering concessions, the Bank helped borrowers navigate these challenges, preventing further financial distress and stabilising the overall economy.

Concessions were primarily provided through loan restructuring, which involved modifying loan terms like extending repayment periods or reducing interest rates. This flexibility helped borrowers manage cash flows and stabilise finances. Additionally, loan rescheduling adjusted repayment schedules to align with borrowers' financial situations, facilitating better financial organisation and repayment management.

These concessions benefited borrowers by averting defaults and maintaining creditworthiness. By preventing loan defaults, the Bank preserved asset quality, ensuring financial stability and continued credit availability. Moreover, supporting borrowers sustained consumer spending, business operations and economic growth, particularly among small and medium-sized enterprises, crucial for job preservation and entrepreneurship.

Setting up a Business Revival and Rehabilitation Unit to support struggling businesses

The establishment of a Business Revival and Rehabilitation Unit by the Bank in 2020 exemplifies its commitment to supporting struggling businesses during challenging times. With the policy direction of the Central Bank, the Bank took steps to expand the scope of the Unit in 2022. This Unit provides targeted assistance, guidance and resources to SMEs facing difficulties due to external and internal challenges and undertakes projects for rehabilitation with a hand holding process. The unit identifies struggling businesses, understands their unique obstacles and tailors solutions to aid in their recovery. By dedicating resources to business revival and rehabilitation, the Bank ensures the survival and long-term success of these enterprises.

The Unit's primary goal is to assess the financial needs of SMEs and identify lending opportunities in specific segments. This may involve providing additional financing, adjusting business processes, or offering concessionary credit lines to alleviate financial burdens. Through close collaboration with SMEs, the Unit understands their needs and provides necessary tools and resources for overcoming challenges.

Moreover, the Unit fosters open communication and collaboration through regular meetings, seminars and workshops with clients and stakeholders. This approach allows for a deeper understanding of SMEs' needs and the development of effective support strategies.

Ultimately, the Unit's success lies in its holistic approach to supporting struggling businesses. In addition to addressing immediate financial needs, it assists SMEs in reevaluating their operations and identifying new market opportunities. By optimising costs and implementing innovative strategies, SMEs can regain momentum and achieve sustainable growth under the Unit's guidance.

The Unit has undertaken 22 projects for business rehabilitation during the year of which four SMEs were successfully rehabilitated and 14 SMEs are under rehabilitation while four SMEs could not be rehabilitated.

Promoting digital innovation and creating new business opportunities

The Bank promoted digital innovation and created new business opportunities by leveraging technology to improve operational processes, enhance customer experience and drive growth. Embracing digital transformation allowed the Bank to identify untapped markets, develop innovative products and services and reach a wider customer base, similar to the rise of e-commerce platforms and fintech companies. Additionally, digital innovation enhanced customer experience by offering personalised recommendations, streamlining processes and providing convenient self-service options, leading to improved customer satisfaction and loyalty.

At the same time, digital innovation improved operational efficiency and productivity through automation, integration of systems and data-driven decision-making, despite challenges such as the need for investment in technology, infrastructure, talent and addressing cybersecurity concerns. Overall, embracing digital transformation enabled the Bank to stay competitive, seize new opportunities and thrive in the digital age.

The Bank adopted digital signatures as an operational process whereby allowing customers to submit digital documents instead of physical paper-based documentation to the Bank.

Commercial Bank is the first Sri Lankan Bank to accept digitally signed documents from business customers using LankaSign operated by LankaClear, the only commercially operating Certification Authority in the country that complies with the Electronic Transaction Act.

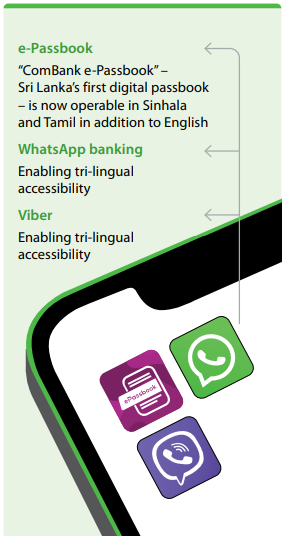

As part of its commitment to sustainability, the Bank prioritises transitioning customers to eco-friendly digital banking channels. Offering six banking apps, including ComBank Digital online banking platform, Flash Digital Bank Account, Q+ Payment App, ComBank ePassbook, ComBank eSlip and ComBank Remit Plus, the Bank also provides social network banking with WhatsApp Banking and Viber Banking. Throughout the year, efforts were made to encourage customers to shift to digital channels, aligning with the Bank’s digital vision of fostering a digital economy accessible to all customers regardless of their technological proficiency.

The Bank's Digital Road Map focuses on retail customers, promoting paperless and sustainable digital products, services, processes and interactions. In 2023, the number of customer transactions carried through digital channels compared to over-the-counter transactions continued to increase as shown in the Graph below;

Notably, the Bank's green-initiative apps given below received top ratings from users compared to competitors across all parameters.

Digital products and services

Combank digital

Q+ Payment App

e-Slip

Remit Plus

WhatsApp and Viber Banking

e-Passbook

Flash Digital Bank Account

Supporting exporters

The Bank played a crucial role in supporting exporters by providing them with financial solutions, market insights, networking opportunities and trade finance services.

The strategic partnership the Bank entered into with the National Chamber of Exporters of Sri Lanka (NCE) helped it to extend financial solutions to exporters, with a focus on SMEs. This partnership aimed to encourage and strengthen SMEs engaged in the export market by providing them with a full range of international banking capabilities and expertise. Additionally, the Bank organised trade fairs, seminars and webinars in collaboration with industry experts such as the Export Development Board (EDB) and the Ministry of Commerce. These events provided exporters with opportunities to showcase their products, learn about market trends and network with potential buyers and partners.

The Bank also offered a range of trade finance products and services to support exporters. These included documentary credits, letters of guarantee, forward exchange contracts, document collection, shipping guarantees, marine insurance and assistance with entrepot trade shipments. These services helped exporters manage their trade transactions, mitigate risks and access financing for their export activities.

Furthermore, the Bank launched the ”Combank Trade Club”, an ecosystem designed to stimulate business growth for its trade customers. This platform provided exporters with access to innovative trade solutions, expert advice and networking opportunities.

Diribala Export Grooming Programme

The Diribala Export Grooming Programme, initiated by the Bank, aims to enhance the export capabilities of businesses and strengthen the export value chains across various sectors, recognising the vital role of the export segment in the economy. The programme focuses on preparing businesses to become export-ready, with an emphasis on understanding export procedures, industry potential, standards and good manufacturing practices.

In its initial phase, the programme involved conducting awareness sessions for 112 potential direct and indirect exporters, providing them with valuable insights and resources. These sessions, facilitated by key institutions such as the Export Development Board, Industrial Development Board, Sri Lanka Standards Institution and National Plant Quarantine Service, aimed to equip participants with the knowledge and tools necessary for successful exporting.

Moving forward, the programme seeks to facilitate market connections for potential exporters, bringing together various stakeholders from the export ecosystem to address their challenges and facilitate their entry into export markets. By fostering collaboration and providing access to resources and expertise, the Diribala Export Grooming Programme aims to support businesses in tapping into the vast opportunities offered by international trade.

Supporting importers

As a result of a shortage of foreign exchange, rapid fluctuations in exchange rates and sovereign rating downgrades, the Bank encountered difficulties in relation to foreign exchange management. However, the Bank effectively addressed customer concerns and expectations, particularly in trade finance, thanks to the fact that a significant portion of export proceeds goes through the Bank. Despite the sovereign rating downgrade, the Bank successfully negotiated reduced commission rates for confirmations with multinational banks, alleviating the financial strain on customers.

Female participation

In the ever-evolving landscape of financial services, the Bank’s dedication to empowering women remained steadfast throughout 2023. A themed campaign revolving around Anagi Women Banking was unveiled in March, featuring prominently in press and media advertisements. The Bank also took to social media platforms, publishing a Women’s Day post showcasing the top four corporate management members. Additionally, a Women's Day event saw a competition to recognise the top five WSME customers in the Colombo region, complete with benefits and prizes, creating a festive atmosphere. This event attracted the participation of 100 attendees.

Furthermore, beyond its core financial services, the Bank showcased its commitment to social causes through strategic non-financial endeavours. A series of social media posts centered around significant events such as Women’s Day, Mothers’ Day, Cancer Awareness Month and Women Entrepreneurs’ Day, engaging the audience and contributing to broader societal dialogues. Leveraging its corporate webpage, Facebook fan page and other social media channels, the Bank disseminated information about its Women Banking initiatives and products through banners, posts and EDMs, ensuring widespread awareness and engagement among its audience.

The Bank’s commitment to skill development was underscored by the extension of the PIM Certificate Programme for Women Entrepreneurs across various regions, including the Northern, the Southern and the Eastern areas. Successful programme completions in Jaffna, Galle and the Eastern region, alongside sessions in Colombo North and Uva Sabaragamuwa, highlighted the Bank's extensive regional outreach efforts.

As of the end of 2023, women-connected SMEs accounted for 51% of the Bank's entire SME loan portfolio, compared to 50% in 2022. The Bank provided facilities to over 15,000 women-connected SMEs, up from 14,000 in 2022 and served over 6,200 women-connected SME customers, up from 5,600 in 2022. Moreover, within the Bank's overall retail loan portfolio, women-connected retail loans represented 32% at the end of 2022 and 34.50% at the end of 2023.

Following the relaunch of the Anagi brand in 2022, the Bank successfully opened over 112,500 new Anagi Women’s Savings accounts by the end of 2023, marking a growth of 21.3% compared to the number of accounts before the relaunch. The growth in the new female customer base recorded a 24.30% increase in 2023 compared to the previous year’s growth of 16.5%.

Customer testimonials played a crucial role in illustrating the impact of Women Banking initiatives, with an inspirational video featuring PIM participants adding a personal touch to the Bank’s endeavours. Furthermore, sponsorships of various media events and the launch of an online portal with IFC & GlobalLinker in March signified significant technological advancements, showcasing the Bank‘s commitment to embracing digital solutions.

The Bank’s dedication to supporting women entrepreneurs extended beyond financial assistance, encompassing comprehensive skill development programmes and tailored non-financial services. Additionally, ongoing branch competitions, employee engagement initiatives, strategic partnerships and database marketing campaigns further demonstrated the Bank's unwavering commitment to empowering women and fostering gender-inclusive workplace practices. Through gender awareness training programmes at all levels and plans to establish a forum for staff suggestions on Women Banking initiatives, the Bank emphasised its commitment to creating an inclusive and collaborative workplace culture.

Sustainable finance for Micro and Agriculture sectors

The Bank demonstrates a robust commitment to Agriculture and Micro Financing, crucial for fostering financial inclusion and reaching under-banked and unbanked communities, thereby bolstering rural economies in particular. Leveraging specialised units like Agriculture and Micro Finance Units (AMFUs) and “Bank on Wheels” mobile banking units to enhance the Bank’s outreach, the Bank extends its services to underbanked and unbanked communities, particularly in rural areas. With a strategic focus on strengthening the rural economy and averting potential food scarcity, the Bank has significantly increased its lending activities in rural and semi-urban regions and supports smart agriculture. Support for smart agriculture included concessionary funding for setting up greenhouses, modernisation of irrigation systems and mechanisation of tea plucking as well as conducting demonstrations on the use of drones for paddy cultivation in collaboration with technology partners. Training programmes conducted by the Development Credit Department for internal staff included microfinance and lending related to agriculture projects.

Facilities disbursed by the Bank for agriculture activities and under Microfinance credit lines as of December 31, 2023 are given below.

| Facility | As at December 31, 2023 | |

| Number of facilities | Amount Rs. Bn. | |

| Agriculture activities | 17,941 | 120.682 |

| Microfinance credit lines |

6,694 | 2.017 |

In addition, the Bank's “Bank on Wheel” operations have facilitated 1,429 loans and opening of 1,172 accounts during the year 2023, bringing the total number of loans and opening of accounts so far under this facility to 2,127 and 13,093 respectively, further enhancing financial access in these areas. Additionally, through partnerships like the one with ADB, the Bank promotes initiatives like the ADB Funded Tea Development Credit line, benefitting 314 customers with loans totaling to Rs. 469.650 Mn.

The Bank’s AMFUs focus on development of micro value chain financing, expanding access to finance for micro and agriculture sectors and grooming micro-enterprises into SMEs and beyond. The Bank currently operates 19 AMFUs covering 63 branches and has plans to expand the AMFU operation by adding further 11 units in the near future to cover 100 branches to aggressively promote micro and agriculture-based lending. This planned expansion of AMFU operations underscores the Bank’s proactive approach to promote Micro and Agriculture-based lending, ensuring sustainable economic development in rural communities.

With the intention of transforming potential Micro entrepreneurs to registered entities and moving them to formal SME stream, the Bank commenced Dirishakthi Micro Grooming programme. During the year, 95 customers have been selected and are being groomed through the specially designed training programmes to enhance their knowledge on Business & Financial Management.

Further, in an effort to enhance value chains in rural regions, the Bank implemented five In-Kind Grant Programmes across Gampola, Mulliyawalai, Vavuniya, Welimada and Nelliyadi areas, benefitting over 370 farmers. These programmes aim to introduce technology, mechanise agricultural projects and improve infrastructure within identified value chains.

Maintaining transparent communication with customers

The Bank maintained transparent communication with customers through various strategies and initiatives. Firstly, it prioritised openness, honesty and accuracy in all communications, ensuring customers were well-informed about products, services and policies. This approach helped to establish credibility and trust, leading to increased customer loyalty and repeat business. Additionally, by providing clear information, the Bank managed customer expectations effectively, reducing misunderstandings and complaints while enhancing overall satisfaction.

The Bank also actively addressed and resolved customer concerns and issues, demonstrating a commitment to customer satisfaction. Through prompt and honest responses to feedback, the Bank showed that it valued customer opinions, thereby strengthening customer relationships and turning potential negative experiences into positive ones.

Training programmes conducted by the Bank on improving financial literacy and capacity building

Moreover, in the digital age, the Bank leveraged social media platforms to engage with customers proactively. By monitoring and responding to feedback and inquiries on these platforms, the Bank showcased its dedication to transparent communication and demonstrated a willingness to address customer concerns promptly. This proactive approach helped to maintain trust and strengthen customer relationships.

To ensure consistent and effective communication, the Bank had clear communication policies in place, outlining how it would interact with customers and address their concerns. It also invested in training employees to communicate effectively, empowering them with the knowledge and skills needed to provide accurate and helpful information to customers.

Overall, by prioritising transparent communication and actively engaging with customers, the Bank was able to build trust, manage expectations, resolve issues and stay ahead of the competition. This commitment to openness and honesty contributed to enhanced customer satisfaction and long-term success for the Bank.

Trilingual presence

The Bank has embraced a trilingual approach in its operations through various initiatives and strategies. These include the establishment of an Integrated Contact Centre in 2020, operating 24/7, allowing customers to connect with the Bank through multiple channels and languages for inquiries and assistance. This ensures that individuals from diverse cultural, religious and ethnic backgrounds can communicate in their preferred language.

Strategies adapted to improve customer experience and sustainability within contact centre.

- Green initiatives

Establishing a centralised knowledge hub within the Contact Centre aimed at enabling operations without the reliance on physical paperwork, enforcing a no-paper policy for Contact Centre agents at their workstations

- Customer engagement

Educating customers and encourage them to use digital channels for their day-to-day Banking operations and communication to the Bank.

Engaging with customers through Outbound calling campaigns to create awareness on banking apps and enrolling them with credit card e-statements instead of the paper statement.

- Employee engagement

Assigning a leader to the unit to spearhead sustainability efforts and raise staff awareness to reduce energy usage.

- Automations with technology utilisation

Implementing IVR (Intelligent Voice Response) to automate specific functions to enhance customer convenience.

Implementation of ”Chat Bot” to provide quick seamless information through the bank official web portal.

Setting up a customer relationship management solution, ”The Service Portal”, internally to manage customer complaints and services requests within the specified Service Level Agreement, ensuring exceptional service delivery and customer satisfaction.

Furthermore, the Bank’s on-site customer service teams are proficient in three languages, ensuring that customers receive support in their chosen language. The Bank’s website has been revamped to offer content in English, Sinhala and Tamil, catering to users' language preferences and enhancing accessibility to information. Introducing digital receipts in multiple languages, accessible via SMS for ComBank Cardholders, further reinforces this commitment. The Bank enabled trilingual accessibility for “Bank with ComBank on Viber” for enhanced user convenience. The Bank launched trilingual service for Q+ Consumer payment app with a view to attract Island wide mass market in to digital space. Overall, these efforts underscore the Bank's dedication to accommodating customers from various linguistic backgrounds and providing a seamless banking experience for all.

Some of the banking products and services now available with a trilingual presence are given below.

Driving customer engagement and market expansion

The Retail Products and Marketing Department has been actively engaged in enhancing customer reach through both traditional ground-level activities and modern social media interactions, with the aim of establishing direct communication channels with customers. Furthermore, promotional campaigns have been executed across various media channels to bolster the performance of product divisions and help them achieve their targets effectively.

Moving forward, strategies will revolve around introducing innovative products, optimising the channel mix, targeting specific markets and enhancing customer profitability. This approach is aligned with the Bank’s commitment to driving value for stakeholders by implementing impactful marketing strategies, expanding product offerings and ensuring a customer-centric approach across all activities.

In the year 2023, the Bank commemorated 20 years of remittance operations by pioneering a sophisticated yet a simple web base money transfer system two decades ago to serve over two million Sri Lankans overseas. Today the Bank is one of the strongest players in the remittance business serving thousands of Sri Lankans who are working in many countries, world wide.

The Bank is further undertaking strategic initiatives to improve its ranking in the remittance market. This includes repositioning Bank representatives in emerging markets and collaborating with international Money Transfer Operators, Exchange Houses and International Banks to serve our focus customer segment in offering more benefits and convenience in this business vertical. Another 1st in the industry was the “RemitPlus App” which was introduced to its remittance stake holder to offer tailor made solutions while also taking steps to integrate systems with emerging technologies to offer speed, security and customer experience.

Specifically, there are plans to strategically reposition remittance partners in emerging markets to further establish the bank’s footprint in potential markets. These efforts signify the Bank’s dedication to strengthening its presence and competitiveness in the remittance market.

An expanding ecosystem

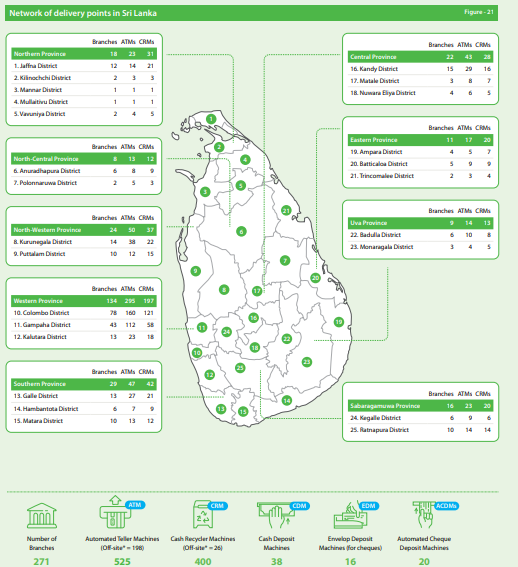

The Bank grew its branch network by opening branches in Anamaduwa and Kanthale during the year.

In year 2023 the Bank commemorated 20 years of remittance operations by pioneering a sophisticated yet a simple web base money transfer system 2 decades ago to serve over two million Sri Lankans working overseas. Today the Bank is one of the strongest players in the remittance business serving thousands of Sri Lankans who are working in many countries, worldwide.

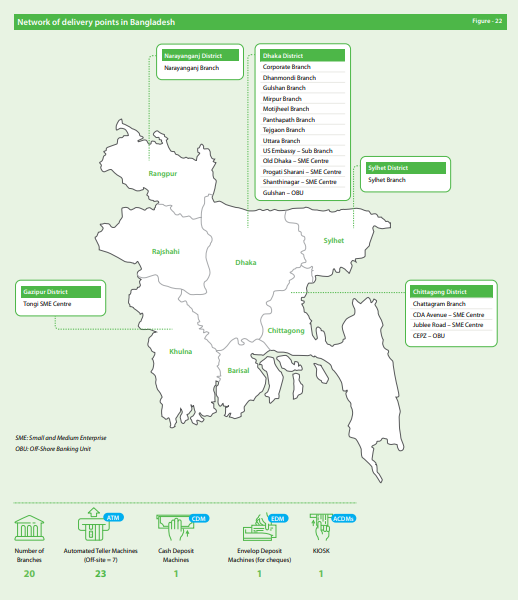

Network of delivery points in Sri Lanka and Bangladesh

New product developments/enhancements

The Bank introduced several new products and made enhancements to existing ones to better cater to the needs of its customers. Among the new offerings, a 4-month Fixed Deposits Scheme was launched, providing customers with a flexible savings option. The Bank revamped its Isuru Minors’ Savings Plan and the Millionaire Investment Plan, aiming to provide more attractive benefits to customers.

Notably, an exciting feature was introduced to the Anagi Women’s Savings Account, entitling their children to a free minor savings account with an initial deposit of Rs 500, fostering financial education from a young age. Further, the ability to perform digital transactions was extended to DotCom Teen Savings Account holders, granting teenagers aged 16 and above fund transfer and bill payment options, promoting financial independence and responsibility from an early stage.

During the year, Personal Foreign Currency Account holders were entitled to a free debit card and digital banking facility with no joining fee and a waiver of the first-year annual fee enhancing the value addition. Furthermore, customers investing in FCY Fixed Deposits with the Bank were given the opportunity to obtain a free premium credit card with no joining fee and annual fee and other value added benefits including complimentary airport lounge access, free travel insurance and other merchant discounts.

In terms of lending, new product launches included Green Home Loans, a revolutionary offering with special benefits to customers obtaining loans to construct or purchase a house with a Green Building Certificate issued by the Green Building Council of Sri Lanka. Green Home Loans are also available to customers who wish to implement other green initiatives such as installing solar power systems, waste and rain water management systems and composting systems. The Bank also introduced step up leasing, a scheme that provides salaried professionals the option to structure their repayments, taking into consideration the projected incremental employment income.

Process improvements

The implementation of an approval workflow for Facilities Against eFDs has brought about significant advantages for stakeholders, including customers and staff members. This advancement has largely eliminated the need for manual appraisal raising in Loan Origination System, thereby freeing up staff time for other tasks and considerably reducing the turnaround time (TAT) for the product. Moreover, this development sets the stage for the complete automation of the approval and disbursement process for Facilities Against eFD.

Efforts have been made to streamline the account opening process for Millionaire Investment Plans, simplifying procedures to minimise technical errors. Additionally, the automation of the Certificate generation process for Millionaire Investment Plans has eradicated delays associated with manual preparation.

Innovative systems have been devised to enhance the efficiency of back-end functions related to Pawning, alleviating the burden on branch teams and line management by simplifying approval processes. Initial steps have also been taken to offer Pawning customers enhanced value through Special LTV, recognising valued banking relationships.

In the realm of innovations, the Retail Products Department introduced the “QuickSales”, a Retail Sales Management App to expedite processes and reduce costs associated with submitting retail facility applications and documentation. This app enables Sales Agents to request retail facilities and upload related documents without the need for physical travel between customer locations and branches. It also extends the benefits of business leads to branches beyond the Sales Team's physical reach, facilitating transactions between customers and outstation branches. Additionally, the QuickSales App offers performance dashboards, enabling users at various levels to monitor open workflows effectively.

Further, as a specific initiative the Bank stopped using receipts at ATMs contributing to the overall strategy of reducing operational expenses while maintaining uninterrupted services.